One need only reflect upon the headlines of late regarding Brexit, Trans-Pacific-Partnership (TPP), Hanjin shipping bankruptcy, and slowing GDP growth to realize that all is not harmonious in the global economy. The common threads that run through these headlines — as well as other noteworthy current events, such as the Syrian refugee crisis and U.S. “secure the border” movement front and center during the 2016 U.S. Presidential campaign — are twofold:

- Unresolved post WWII reconstruction monetary, political, and trade policies exacerbated by conflict between the dominant 20th Century industrialized nations (G7) and 21st Century, Emerging Market economies with greater populations. These Emerging Market economies are demanding more influence over currency, labor and trade matters — and the organizations that determine their outcomes;

- Disruptive technologies that are effectively reducing demand for labor. In essence, these technologies are fueling isolation behaviors that underlie Brexit, anti-TPP sentiment and anti-immigration policies across Europe, North America and Latin America. Left unaddressed, more volatility and conflict is ahead that serves to only inhibit economic and GDP growth for all.

Neither of the aforementioned are easy challenges to tackle, yet alone solve. We can’t put the genie back in the bottle in terms of global interconnectivity or advancing disruptive technologies such as robotics, 3-D Print manufacturing and driverless vehicles. Today’s global economy is at an inflection point not dissimilar to that experienced at the onset of the industrial age or end of World War II requiring massive reconstruction in Europe to rebuild a sustainable peace. The question that needs to be answered in advance of another period of isolationism that will inevitably lead to another world war type conflict is: How do nations collaborate and reconstruct a new model that promotes growth beyond today’s narrow band of industrialized nations? In essence, what is the modern-day Marshall Plan (European Recovery Plan) for a 21st Century Disruptive Technologies era (think of it as an “Emerging Markets Economic Participation Plan”)?

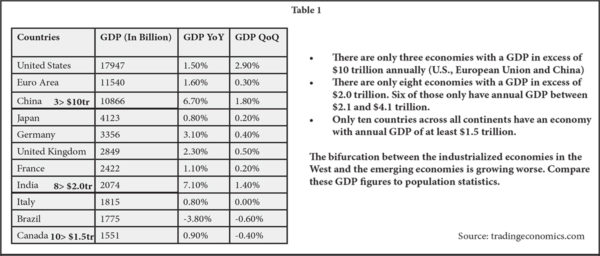

Let’s first put in perspective the disparity in global economic growth. In Table 1 from tradingeconomics.com (one of my top five recommended economic sources) highlights the economic disparity.

Let’s first put in perspective the disparity in global economic growth. In Table 1 from tradingeconomics.com (one of my top five recommended economic sources) highlights the economic disparity.

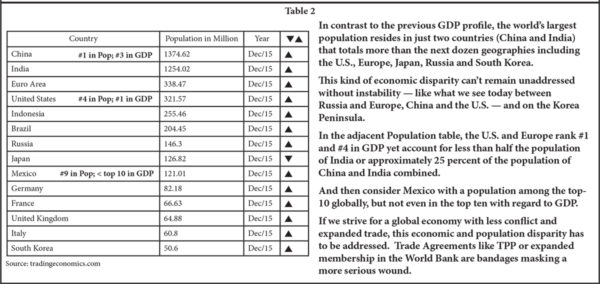

When one then compares the population statistics to the GDP rankings, the economic bifurcation is quite stark. Table 2, also from tradingeconomics.com highlights this economic-to-population disparity. Not only does it feel like just a few geographies control the economic equation and fate of global GDP, the control over the elements that drive this disparity also reside in the control of the few dominant post WWII industrialized nations — and not the emerging nations with population masses. The control elements include, but are not  limited to:

limited to:

- Primary financial markets — London and New York located in the two geographies with most GDP;

- Monetary Policy Leader — Federal Reserve Bank of the United States (Top-ranked country in GDP);

- Trading organizations such as the G7; and

- Banking — not just the dominant U.S. and European ones but the World Bank as well.

This control of so many of the ingredients that determine the economic pie by a few is a recipe for conflict and economic instability. And that is what we are seeing play out in response throughout Asia, the Middle East, and Europe.

So what is the answer to this first challenge? Maybe the commercial real estate professionals can determine that; however I will proffer that the answer has to start with a recognition of the following:

- Leadership is lacking on the global stage. Brexit was a wake-up call this past Summer. And now the UK “Supreme Court” has ruled that the UK cannot proceed with initiating the people’s desire to divorce from the European Union until Parliament approves the decision. I kid you not. Refer to the following coverage of the UK court ruling during the first week of November 2016. Could this be fortuitous to future U.S. Supreme court rulings on matters of trade, post new judicial appointments in 2017 under a new U.S. President? Are we on the verge of a new era of isolation?

- The 2016 U.S. Presidential campaign has also served as an eye-opener for the isolation thinking and anti-trade sentiment from the middle-class that blame trade agreements like NAFTA, versus disruptive technologies in manufacturing resulting in most of the middle-class job loss in the U.S. A redo of NAFTA or TPP won’t bring those jobs back. The robots have them now.

- And the leadership challenges become more severe in 2017 and 2018 when FED Chair Janet Yellen and her ZIRPTI monetary policy (zero interest rate policy to infinity) are up for reappointment; and Germany’s Chancellor Angela Merkel faces her own re-election challenge as head of Europe’s largest economy amid growing discontent over her refugee policy — a re-election that is shaping up to be “Brexit the sequel.”

- The World Bank and post WWII reconstruction structures/organizations have served their purpose and need to be rethought to address the need for a new type of Marshall Plan — an “Emerging Markets Participation Plan.” The World Bank has morphed from a single-institution entity post the end of WWII with a single mission to reconstruct Europe to a bureaucratic 189-member institution with a primary focus to eradicate poverty. This mission, while laudable, looks, feels and sounds like “wealth redistribution” to industrialized nations like the U.S. Import/Export Banks is undermined by currency manipulation and monetary hanky-panky that originated with the U.S. Federal Reserve long before China learned the behavior. When one nation’s currency sets the price of the world’s most needed commodities (oil to soybeans), emerging markets don’t stand a fighting chance when that nation wants to advance its economic growth at the expense of other nations. The ZIRPTI by the U.S. Federal Reserve, in response to the 2009 Financial Crisis, has been exported to Europe and Asia — and now we face a race to currency devaluation without understanding the unintended economic consequences.

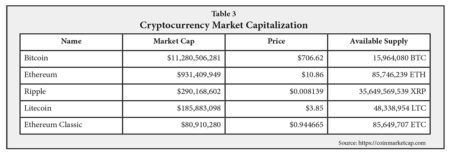

- The U.S. Dollar as the world’s reserve currency is at real risk from cryptocurrency. The U.S. and EU monetary policy behavior is driving global interest in a substitute reserve currency and cryptocurrencies like Bitcoin and BitMint. What are the implications for commodity prices like oil and agriculture that are principally priced using the U.S. Dollar? Don’t be so quick to dismiss the cryptocurrency movement by the emerging market economies. Cryptocurrency is viewed as a way to neutralize currency manipulation and disruptive monetary policy by the U.S. and EU. The emerging markets will use cryptocurrency technology to displace a single-country reserve currency (the U.S. Dollar) in the next decade. A review of the top-trending cryptocurrency news stories as of the first week of November 2016 revealed that even the UK bank regulator is studying the implications.

The top five cryptocurrencies in circulation today represent a market capitalization that has grown to approximately $12.2 trillion U.S. Dollars — or 2/3 of U.S. annual GDP. Cryptocurrencies are no longer eclectic or theoretical. They are real and increasingly utilized by emerging economies to conduct trade due to their trade imbalances with the U.S. and Europe. Trade deficits could be eradicated by global use of cryptocurrency. Then what influence will central banks have on economic activity?

Any doubt remaining that these two primary problems are not going to be easily resolved? With challenge #1 in perspective, let’s turn to the second big global economic challenge: Disruptive Technologies.

Disruptive Technology: The dirty little secret and dialogue that politicians don’t want to have with manufacturing and middle-class labor is that automation, robotics and technology are eliminating labor across all industries and countries — and at a pace that surpasses job loss from any legacy trade agreement. White-collar employment in architectural design, engineering, financial services, legal and medical industries are all under siege as much as manufacturing and transportation industries experienced in the 1970s, 1980s and 1990s, but this time from technological advances that can perform analytical, design, and even diagnostic functions cheaper, faster and more consistently than human labor. As industry faces skilled labor shortages, rising wage pressures, and the need to pay for double-digit increases in costs like medical care, employers are turning to technology to solve the problem.

Banks are adopting mobile device technology to replace the teller function and traditional branch banks. Government agencies are deploying self-service kiosks to enhance customer service and improve efficiency. Healthcare and retail are adopting the kiosk technology to control costs and enhance delivery of services. It’s not just ATMs, automated parking attendants or vending services dominating the kiosk revolution.

Kiosk Marketplace reports on the growth of the kiosk industry, and projects more than 10.9 percent annual growth of kiosk delivered services between 2016 and 2024.1 It reported in October of 2016 that retail and healthcare are the two major kiosk applications in North America, with retail emerging as the dominant and the fastest growing sector.2 Within retail, the use of kiosks for bill payment emerged as the largest sub-segment in 2015 (in other words elimination of the checkout labor that used to employ students, part-time laborers and lesser skilled workers). And within healthcare, the use of kiosks for hospital information is displacing the front office clerical staff in hospitals and doctors’ offices. So what is to become of this displaced labor?

Kiosk Marketplace reports on the growth of the kiosk industry, and projects more than 10.9 percent annual growth of kiosk delivered services between 2016 and 2024.1 It reported in October of 2016 that retail and healthcare are the two major kiosk applications in North America, with retail emerging as the dominant and the fastest growing sector.2 Within retail, the use of kiosks for bill payment emerged as the largest sub-segment in 2015 (in other words elimination of the checkout labor that used to employ students, part-time laborers and lesser skilled workers). And within healthcare, the use of kiosks for hospital information is displacing the front office clerical staff in hospitals and doctors’ offices. So what is to become of this displaced labor?

And the challenges just get greater when one starts to layer in 3-D print manufacturing, logistics technology that is remaking the supply chain and need for warehouse workers who are being replaced by robotic forklifts and automated conveyor systems to read, handle and direct packages from shipping container to delivery truck. And what about driverless vehicle technology that is already in testing by retailers such as Wal-Mart or shipping companies testing drone shipping vessels being developed by Rolls Royce?

Even China understands that industry no longer has to chase cheap labor around the world and it too must contain rising labor costs. Mexico now has a wage rate 20 percent below that of Asia’s and China is responding by becoming the world’s largest purchaser of robots to replace workers. The International Federation of Robotics tracks the data on robot purchases. In its latest report covering CY 2015 global robotic purchases, it reported the following:

In 2015, robot sales increased by 15 percent to 253,748 units, again by far the highest level ever recorded for one year. The main driver of the growth in 2015 was the general industry with an increase of 33 percent compared to 2014, in particular the electronics industry (+41 percent), metal industry (+39 percent), the plastics and rubber industry (+16 percent). The robot sales in the automotive industry only moderately increased in 2015 after a five year period of continued considerable increase. China has significantly expanded its leading position as the biggest market with a share of 27 percent of the total supply in 2015.3

Conclusion

Each generation faces a different global landscape and set of economic challenges. At the onset of the Industrial Age in the mid-18th Century, Great Britain wrestled with what an economy would look like with power tools instead of hand tools. Eventually, all adapted and the world economy expanded at historic rates of growth. Post World War II, the U.S. wondered how it would absorb returning GIs into an economy that was no longer fueled by wartime manufacturing. By 1950 the U.S. economy reached a record annual GDP growth rate of nearly 17 percent. Europe wondered if it had a fate in the aftermath of WWII with so much destruction. Who would rebuild it? During the energy crisis of the 1970s and rampant inflation that saw the Prime Lending Rate rise to 21 percent by 1981, America and Europe struggled with unimaginable inflation and an uncertain future dependent on Middle East and OPEC oil. By 1987, the world evidenced a collapse in energy prices and quickly abandoned concerns about economic growth without cheap oil. In 2009 the world evidenced the “Great Recession” and assumed a repeat of the Great Depression was inevitable. Less than a decade later many seem to have forgotten the “Great Recession” and have replaced the angst over our banking system with a new found form of isolation fueled by the unknown of terrorism and ISIS. A void in global leadership exists, and that void, combined with a fear of what disruptive technologies mean for all kinds of industries across all continents, is our new global economic challenge. We are a small world with big economic challenges, but they are not insurmountable. In the words of Franklin Roosevelt, “the only thing we have to fear is fear itself.”

Leadership can develop a new Marshall-type Plan to promote an “Emerging Markets Economic Participation Plan” to keep peace amidst renewed cries for isolationism. Disruptive technologies will eliminate some types of jobs but other employment and career opportunities will emerge like they did during the Industrial Age. A quick tour of Monster.com will reveal job categories that didn’t exist just 5 years ago for Drone Pilot instructors, 3-D CAD analysts, etc. On the eve of the U.S. Presidential election, UK Supreme court ruling the “people’s Brexit vote is invalid without Parliament’s approval,” anti-TPP sentiment for fear of another NAFTA job killing trade agreement, and growing anti-immigration sentiment across both Europe and North America, the greatest threat to the global economy is fear. A return to 3 percent global GDP growth will not ensue until we develop a modern day Marshall Plan to address the imbalance in emerging market economic participation and how to redeploy less skilled labor displaced by “Disruptive Technology.”

Endnotes

1. See Report at: https://www.kioskmarketplace.com/news/report-kiosk-market-to-expand-rapidly-through-2024/ (Accessed March 8, 2017). ↩

2. See: http://www.transparencymarketresearch.com/north-america-kiosk-market.html (Accessed March 8, 2017).↩

3. See Report: http://www.ifr.org/industrial-robots/statistics/ (Accessed March 8, 2017).↩