Recommendations by the CRE® Consulting Corps

The Counselors of Real Estate’s Consulting Corps delivered strategic guidance and an action plan to Naval Air Station Oceana. The first in this 4-part series provides an overview of the project, input from stakeholders, economic and demographic data and market analysis.

Read: Part 2 | Part 3 | Part 4

Watch: Virginia Beach City Council Workshop – November 24, 2020

Capt. John Hewitt, NAS Oceana’s Commanding Officer, describes the work of the Consulting Corps at a City Council Meeting.

Project Overview

The mission of Naval Air Station (NAS) Oceana is as a Shore-Based Readiness Integrator, providing facilities, equipment and personnel to support shore-based readiness, total force readiness and maintain operational access or Oceana-based forces.

The Navy has an interest in exploring alternative options to facilities and land uses in and around NAS Oceana (aka Future Base Design). NAS Oceana management currently encompasses facilities management for core and non-core activities. The Navy is considering turning the management of non-core facilities and functions over to private non-government and non-military operators. NAS Oceana management desires to focus on the core mission and explore alternatives that will add value to the installation as well as to the uniform service members’ quality of life.

NAS Oceana and NAVFAC MIDLANT [Naval Facilities Engineering Command Mid-Atlantic] approached The Counselors of Real Estate (CRE) for expertise to analyze non-core activities, land and buildings to provide options for privatization where practicable. The Counselors is a community of expertise, talent, and professionalism among practitioners recognized as leaders in the real estate industry who have been invited to membership and awarded the CRE designation. The international membership of approximately 1,000 CREs share a commonality of integrity, competence, community, trust and service.

To assist the Navy, The Counselors assembled a team via the Consulting Corps. The Consulting Corps, a public service program of The Counselors of Real Estate, provides real estate analysis and action plans for municipalities, not-for-profit organizations, government entities, educational institutions, and other owners of real property.

CRE® Consulting Corps teams provide objective analysis and strategic counsel on how to best leverage real estate assets. Each Consulting Corps assignment is conducted by a team of well-qualified volunteer members of The Counselors of Real Estate with expertise specific to the needs of the client. The team delivers unbiased, market-driven action steps to address a real estate challenge, often enhancing the performance of a property or portfolio and improving the financial well-being of the client.

NAS Oceana specifically requested the CRE® Consulting Corps team develop a detailed Strategic Plan that includes strengths, opportunities and constraints for the implementation of redevelopment and site renewal opportunities using private, nongovernment operators. The project was divided into five tasks.

- Task 1: Data Collection/ Assessment/ Interviews

- Task 2: Analysis of the data collection

- Task 3: Present potential ownership/ lease/risk structure for development

- Task 4: Recommend strategies to ensure quality of life at a reasonable cost

- Task 5: Create Strategic Plan Report for short and long-term actions

Watch: Statement of Work

Jerry Turner, CRE, presents the statement of work in a webinar on March 31, 2021.

The CRE® Consulting Corps team collected data on all the land and facilities under consideration. The team was given the opportunity to tour the site and several structures. Members of NAS Oceana’s management team were interviewed to afford the team a greater understanding of their operational practices and perspectives on the current situation at the installation.

Community stakeholders were interviewed by the team to understand how they view the Navy’s Future Base Design initiative at NAS Oceana. Real estate professionals were interviewed to allow the team to better understand the market drivers for the land uses allowed on the sites under consideration. Businesses with an interest in development, leasing and construction were interviewed to understand if there was demand from end-users to purchase, occupy or construct facilities for their use. Finally, Local, State and Federal elected officials were interviewed to obtain an understanding of the political climate and the willingness of those in authority to support the Navy’s exploration of alternative options for existing facilities and land uses in and around NAS Oceana.

This report provides a description of the CRE® Consulting Corps team’s observations, analysis, findings and recommendations.

Figure 1: NAS Oceana Accident Potential Zones (APZ) overlay map

CRE® Consulting Corps site visit exit briefing

Findings

The CRE® Consulting Corps team obtained and analyzed information from a wide variety of sources ranging from installation property reports and operational cost data, to local and regional market studies, to personal discussions with a wide variety of sources. The following analysis groups these data sources and analyzes each to develop conclusions according to the assigned task.

Participants and Contributors

The participants providing the information used by the CRE® Consulting Corps fall into distinct groups. These groups include Navy personnel (servicemembers and civilians), community stakeholders (interest groups, City staff, consultants, etc.), real estate professionals (brokers, consultants, appraisers, etc.), Businesses (developers, construction companies, potential tenants, etc.), and elected officials. These participants and contributors are listed below.

Navy Participants

RADM Charles Rock, CAPT John Hewitt, CAPT Robert Holmes, CDR Lakeeva Gunderson, CIV John Lauterbach, CIV Paul Moomaw, CIV Rich Riker, LT Burrell, CIV Bobby Worley, LCDR David Sare, CIV Brian Payne, CIV Michael Wright, CIV Terra Fisher, CIV Blake Waller, CIV Bobby Whirley, CIV Brent Brown, CIV Mark Outman, CIV Ken Snyder, CIV Andrew Porter, CIV Ed Garner, CIV Brent Brow, CIV Bob Crane, CIV Noel Manalo, CIV Hector Gortaire, CIV David Yaw, CIV Scott George, CIV Jamee Martocci, CIV Elizabeth Dietzmann, CIV Debbie Vanbuskirk, CIV Alex Plascencia, CIV Dean Williams, CIV Sarah Ringo, CIV Kenny Steen, CIV Norm Aurland, CIV Rick Butler

Comments from Navy participants and contributors:

- “If the Navy flies $90M planes off $3B Ships, something’s got to give…”

- “We are in breakdown maintenance mode; critical maintenance only.”

- “There is a lot of opportunity to consolidate.”

- “We would have capacity for 1,911 beds but can only quarter about 800 now.”

- “If the fence moves, all we need is a clear understanding of security jurisdiction.”

- “The City may not have a Federal Nexus or be subject to the same level of scrutiny.”

- “Relief from [Morale, Welfare, and Recreation] MWR could reduce Base Ops Cost by 10%.”

- “To make Oceana whole would take more than $100M for deferred maintenance.”

- “Bowling is losing money.”

- “In-kind services would be determined using Navy costs, not private sector costs…”

City of Virginia Beach Participants

Mayor Bobby Dyer, Councilman Guy Tower, Councilman Aaron Rouse, Bob Matthias, Brian Solis, Taylor Adams, Ray White

Comments from City participants:

- “The City views this as a once in a lifetime opportunity to work with the Navy…”

- “I like the idea of being able to use land to create jobs of any kind…”

- “I am open to any option and will help Council see the bigger picture…”

- “We have 6 municipal golf courses, and we want to get out of that business…”

State and Federal Representative Participants

Charlotte Hurd – Military Liaison for U.S. Sen. Mark Warner, Janet Lomax and Diane Kaufman for U.S. Sen. Tim Kaine, State Senator Bill DeSteph, State Representative Barry Knight

Comments from State and Federal Representative participants:

- “The State will support anything the Navy and the City want to do…”

- “Dillon’s Rule1 does not apply to an EUL [Enhanced Use Lease]…”

- “There will be no problem getting support at the State level…”

- “I am concerned about businesses leaving the State of Virginia…”

Real Estate and End-User Participants

Ben Davenport – GTS, Craig Cope – Harvey Lindsay Commercial Real Estate, Justin Ballard – S.B. Ballard Construction, Worth Remick – Colliers International, Kathy Owens – Beach Development Group, Susan Gaston – Gaston Group, Gaylene Watson & Ricky Elder – Dominion Energy, Robert Kerr – Kerr Environmental Services, Greg Belliveau – Apple Moving & Storage, Jeff Hodgson and Skyler Thomas – Freedom Shooting Center, Nicole Campbell – Divaris Real Estate, Steve Brennan – Boeing, Terrie Suit – Virginia REALTORS® Association, Rob Sult – Harvey Lindsay, David Phillips – Apple Moving & Storage

Comments from real estate and end-user participants:

- “After the June 2019 meeting, we couldn’t determine how an EUL would offset costs in a meaningful way…”

- “We would have interest in the stables and golf course for development purposes…”

- “We prefer to work with the Navy on contracts but the EDA on real estate…”

- “To move to Oceana would require incentives that the Navy doesn’t control…”

- “We thought FBD was great, but it will take forever to implement…”

- “Too much work for a developer before the site is ready, and developers don’t want to spend money unless they have a tenant…”

- “I wasn’t sure how to reach out to the others participating in the [June 2019] meeting…”

- “I would love to lease buildings on the campus; there’s no office space in that area…”

- “We can get tax-exempt financing for public projects…”

- “It’s hard to mitigate over 2 acres of wetlands, and forested areas require a 2:1 ratio…”

- “Location near the freeway doesn’t matter (to us) as long as we have base access…”

- “I’m disappointed the Skeet Range didn’t advance; we’re booked when 2 carriers are in…”

- “There needs to be a feasibility study completed for FBD…”

- “Hmm. Ten years to get a deal done with the Navy or one year with the EDA. I’ll take the EDA…”

- “The Navy is always averse to looking at all options…”

- “We need 140 acres in the spring of next year…”

Figure 2: Current NAS Oceana fence line configuration

Figure 3: Possible NAS Oceana fence line configuration.

Other Community Stakeholder Participants

Dr. Jeff Tanner – 757 Recovery, RADM (Ret) Craig Quigley – Hampton Roads Military and Federal Facilities Alliance, Tammie Mullins-Rice – Seatack Civic Organization, Bryan Stephens – Hampton Roads Chamber, Steve Romine – Hampton Roads Chamber, Chris Gullickson-Port of Virginia, Amy Parkhurst – Hampton Roads Alliance, Nicole Ryf – Hampton Roads Alliance, Jim Spore – Reinvent Hampton Roads, Tom Frantz – Williams Mullen

Comments from other community stakeholder participants:

- “Our primary concern is traffic and what they plan to do with the Owls Creek parcel…”

- “The Navy and City need a strong communication plan…”

- “There needs to be a deliberate and detailed communication plan from sailors to big Navy…”

- “We are ready to help. What can we do…?”

- “The Dillon rule precludes collaboration between the cities. They don’t work together…”

- “Five years ago, Norfolk wanted to build a mall, but Virginia Beach wouldn’t give them access to the freeway…”

- “Many professionals won’t move to Virginia Beach because there are no lateral career options…”

- “In 2019 the General Assembly passed a law encouraging cities to work together to achieve financial and economic goals…”

Observations

These comments (and others) assist us in understanding the perspective of all involved in, or influenced by, Future Base Design. Each participating group offers a different perspective.

Navy Participants

Referencing the comments and conversations, we saw two clear facts. The Navy installation management team at NAS Oceana receives Base Operations Support (BOS) funding far below the level required to sustain a nearly 70-year-old installation. NAS Oceana is prepared to take steps to make measurable changes to its current operations, site boundaries and ownership structure in order to balance its BOS deficits, and maintain mission readiness. Thus, the CRE® Consulting Corps team believes NAS Oceana is prepared for bold changes to fulfill their Future Base Design initiative objectives.

City of Virginia Beach Participants

The participants from Virginia Beach included City staff and elected officials. The influence and impact of the 2005 BRAC is still evident in the comments and discussions with them. Overwhelmingly, Virginia Beach supports the Navy and its goals to maintain mission readiness, whatever they may be. However, the City appears to be playing defense versus offense. The City responds to any request of them by NAS Oceana but are hesitant to propose any cutting-edge concepts or ideas and risk damaging their relationship.

The City clearly understands the impact Future Base Design could have on its economy and its future, not to mention its relationship with the Navy. To that end the City is prepared to work with NAS Oceana in any way the Navy desires. However, Virginia Beach (or any City) has no experience with, nor is it prepared for, an initiative of this magnitude. Regardless, the City seems to be a willing, capable, eager and trusted partner, prepared to team with NAS Oceana.

The CRE® Consulting Corps rarely sees the level of municipal enthusiasm exhibited by the City for Future Base Design. We believe this is a surprisingly positive sign and bodes well for the success of this initiative.

State and Federal Representative Participants

Recognizing that NAS Oceana comprises a significant portion of the Virginia Beach economy and Virginia is a commonwealth, subject to the Dillon Rule, the CRE® Consulting Corps believe State and Federal support may be necessary for the success of Future Base Design. The interviews of elected State officials and the liaisons for Federal officials make clear that each is prepared to support this initiative, once it is clearly defined.

The CRE® Consulting Corps team believes the level of State and Federal Representative support is equal to that shown by the City of Virginia Beach, and necessary for Future Base Design.

Real Estate and End-User Participants

These participants represent an eclectic collection of individuals and companies that offered diverse views of Future Base Design. Most attended the June 2019 Industry Day forum and were candid about their perspectives. The overriding theme was a collage of support, willingness to listen, doubt anything tangible will result, and desire to share ideas for success.

Beginning with the brokerage community, brokers make money only when a transaction (sale or lease) occurs. For that reason, they do not like to waste time if they do not sense a “deal” is imminent. This group appeared to be the most skeptical of those interviewed. After the June 2019 meeting, we believe it is safe to say the brokers did not see a clear path to executing a transaction in the foreseeable future. However, they almost universally agreed they would rather work a deal with the Economic Development Authority (EDA) than the Navy, citing too many differences in communication (language) and business practices.

Developers fall into two categories, land developers (subdivisions, business parks, etc.) and vertical developers (those who build on developed land). Land developers make money when they sell finished sites to vertical developers. They have a longer-term view of business, but they look for land they can purchase (or lease) cheaply and can sell quickly. Vertical developers usually will not purchase land for construction until they have an end-user (buyer or tenant). Surprisingly, this group was optimistic, and some knew of prospective end-users they could entice (or desired) to locate on developed sites on the Station. A few from this group suggested they were vertically integrated and could assume both roles. However, most did not have a clear picture of how to transact with the Navy, and universally felt more comfortable working with the EDA on real estate transactions.

The “End-Users” (companies that would occupy the buildings on sites and pay rent long term, aka tenants) each had unique perspectives. One company representative was doubtful his company would expand their presence on the installation without “incentives” (usually tax breaks), while a vertical developer indicated a different part of the same company would be eager to establish a new footprint on Station. Another company desperately wanted the most development ready site and appeared anxious to obtain it. Yet another wanted the same site but would also be interested in a portion of the golf course for their project. Three things were clear from this group: they were very interested in building on leased land, they were concerned about Navy strings if they did, and they all preferred to work with the EDA over the Navy for real estate transactions.

The CRE® Consulting Corps team believes the real estate and end-user communities are prepared to embrace Future Base Design at NAS Oceana when it begins to take on the appearance of a real estate “deal” they are familiar with. That means when their investors and lenders can easily identify the industry checks and balances that allows them to apply standard risk and return criteria to deal. Specifically, it needs to look more like what they are accustomed to in the marketplace.

Members of the CRE® Consulting Corps team review NAS Oceana maps.

Other Community Stakeholder Participants

This group is also very eclectic and encompasses organizations with an interest and influence in Future Base Design at NAS Oceana. Their perspectives ranged from the parochial to strategic and offered good insight into external challenges and opportunities moving forward. During our discourse we learned that no single group opposed Future Base Design at NAS Oceana, and generally supported the concept. However, the greatest concern was the lack of communication about the plan moving forward. They believe communication will be the key to success.

The CRE® Consulting Corps team agrees a clear communication plan will be essential to the success of Future Base Design. The plan should include the goals of the program, the process it will follow, milestones, how the community can help, and periodic updates. Community stakeholders can be the best advocates or the greatest roadblock for bold initiatives like these. NAS Oceana should make a concerted effort toward continuous outreach to these organizations to avoid execution pitfalls.

Conclusions

The CRE® Consulting Corps conducted over forty (40) interviews in person, online, or by video/ conference call to understand not only the challenges facing Future Base Design but to determine why those challenges exist. We discovered surprising levels of support among all the groups we spoke with and very little resistance to the concept. The greatest concerns described to us were the ability of NAS Oceana to execute a transaction and the amount of communication needed with all groups represented.

When asked, real estate developers and end-users preferred working with the EDA over the Navy. Fears ranged from the time it would take to execute the transaction to the possibility the transaction could be annulled after they had made meaningful financial investments.

At the installation level, all of the Public Works departments seemed resigned to the fact that the current funding status would not sustain operational requirements indefinitely, the deficit is building, and financial relief is nowhere on the horizon. There appears to be no resistance to Future Base Design as a solution to the Navy’s current situation. This consistent acquiescence bodes well for NAS Oceana’s ability to execute a transaction.

In our experience, any Future Base Design initiative – whether involving Privatization, EUL, Shared Services, and/or City-Base – requires three critical factors for success.

- Strong, capable and competent support at the installation level;

- Enthusiastic Community and State support; and

- Active engagement from Federal representation.

Our interviews with the participants made clear all three requirements are in place for NAS Oceana to obtain permission and support to execute a transaction. However, the skills necessary to execute a transaction directly with the private sector may be lacking to allay their fears. To that end, we see the EDA as a possible conduit to achieve the desired objectives for Future Base Design.

The EDA has several distinct advantages over other tenants. They are a non-profit and have no investors pressing them for returns. They have experience leasing, owning and developing real estate. They can secure essential services from the City of Virginia Beach for the installation. Their goal is economic growth, and they have bonding (financing) capability. Specifically, they have the ability to obtain financing for projects (infrastructure or buildings) by selling bonds in a fraction of the time it would take NAS Oceana to secure MILCON for the same project. Finally, they have a vested interest in seeing NAS Oceana’s Future Base Design initiative succeed.

If the EDA were to assume the position of Master Tenant, it is important the Navy view them as a conduit through which it will receive greater benefits supporting Future Base Design. With the EDA as an intermediary the Navy gains expertise for master planning, shared services analysis, land development expertise and a host of other support the Navy may be challenged to obtain on its own.

The CRE® Consulting Corps team recommends NAS Oceana pursue a strategic partnership with the City of Virginia Beach Economic Development Authority through an EUL or City-Base transaction.

CRE Consulting Corps tour of Jolly Rogers Squadron facility at NAS Oceana.

Economic and Demographic Data Analysis

NAS Oceana is located near the center of the City of Virginia Beach (350 square miles), which has a population of 453,000± residing in 182,000± residences within the City. Virginia Beach is located in Hampton Roads in the Chesapeake Watershed, abutting the Atlantic Ocean. The population within 30 miles was 1,294,700 in 2019 and is projected to grow to 1,325,000 in 2024 (+2.3%).

The Hampton Roads region is part of the Atlantic Sun Belt and also at the southern end of the Boston-Washington megalopolis. The region has a very strong military presence, especially with the Navy. It has a strong veteran and retiree population. The median age in the region is 36.1 versus the U.S. average of 38.5. Currently, the median household income is $64,950 (compared to $60,500 for all U.S. households). Thus, Hampton Roads is a thriving region, benefiting from its proximity to the nation’s capital and location at the northern edge of the Sun Belt.

Virginia Beach benefits from its relationship with the military (11,000± soldiers and sailors separate from military service in this area each year), providing a growing workforce, most with technical skills and education. Even so, the region does not have a strong manufacturing base. We were told that it is challenging to recruit senior managers as the local market is thin (if a senior-level employee were displaced, there are few alternatives in the immediate region).

The key advantage that the region has is the affordability in a region on the Atlantic Coast. It is the most northerly of Sun Belt markets, which portends for continued competitiveness and growth in the coming years.

The current pandemic has exposed the potential weakness of the large hospitality and vacation component to the region’s economy. This provides an impetus to grow the manufacturing and technology sectors to create more balance and stability. Most former service members fit into this strategy given their technical training and skills. The quality of life in the region ensures that many want to stay in the region if they can find employment.

Conclusion

NAS Oceana’s Future Base Design initiative does not conflict with the economic trends and labor force strengths in the Virginia Beach and broader Hampton Roads region. The CRE® Consulting Corps team believes the authorized land uses within the Station’s Accident Potential Zones (APZ) would be well received and support the burgeoning demand for warehouse and distribution space in the region.

Market Analysis

Overview of the Virginia Beach Commercial Real Estate Market

The City of Virginia Beach is the most populous city within the Commonwealth of Virginia with a population of approximately 450,000. The northern part of the City is urban while the southern sections are more rural. It is home to three military installations, Virginia Wesleyan University, Regent University, and miles of beaches with hundreds of hotels and resorts. The City became a vacation destination due to its location on the ocean and because it is south of the average storm track of storms originating in higher latitudes and north of the usual track of hurricanes and tropical storms. Defense, real estate and tourism are the primary industries within the City’s economy. The population is relatively stable, growing 3% over the past decade. Virginia Beach is located within the Hampton Roads Metropolitan Statistical Area (MSA), along with the cities of Chesapeake, Hampton, Newport News, Norfolk, Portsmouth, Suffolk and other smaller cities. The MSA population is approximately 1.7M.

While the City of Virginia Beach is the largest city within the MSA, Norfolk is the central business district with Virginia Beach functioning as a suburb.

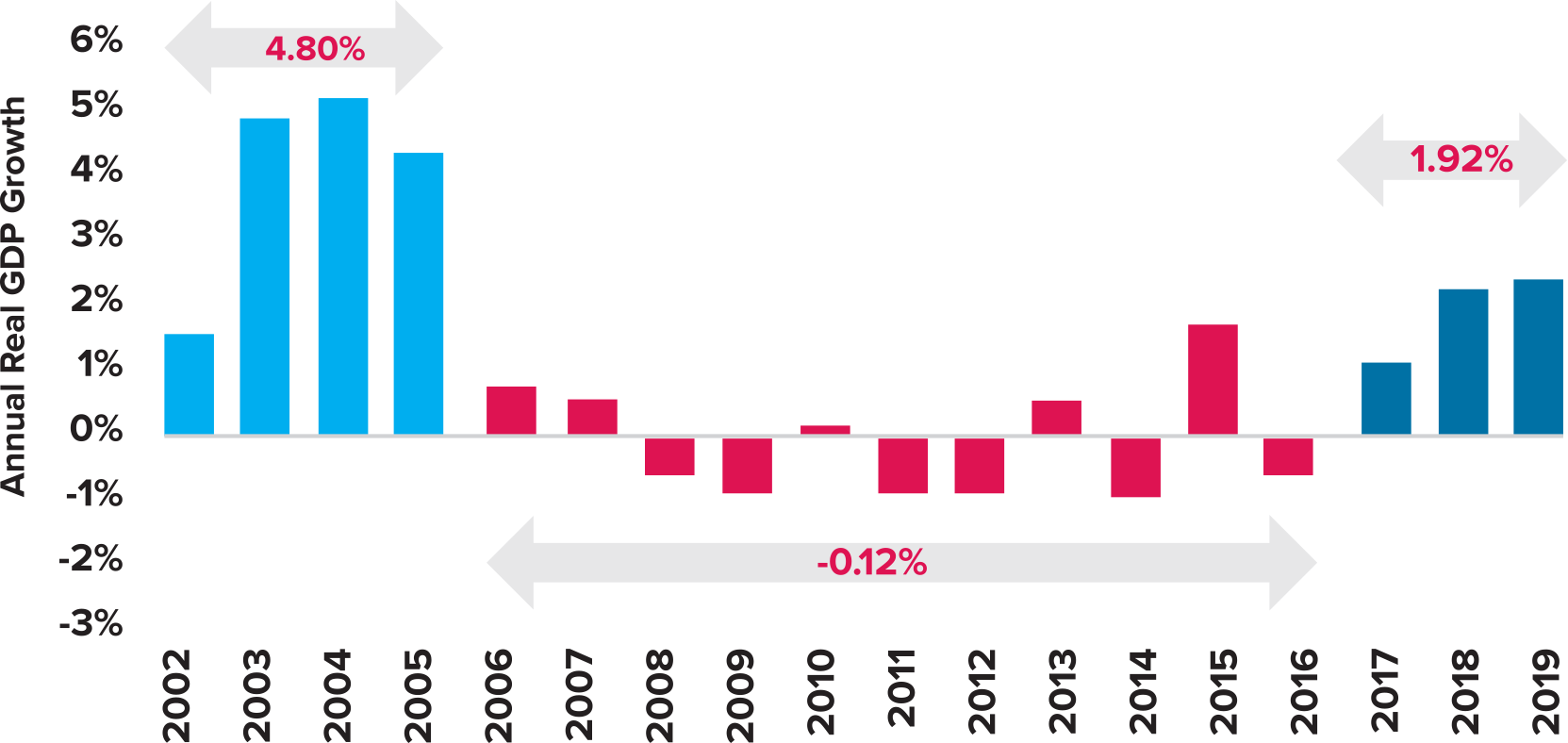

According to the 2020 Hampton Roads Real Estate Market Review and Forecast published by Old Dominion University’s E. V. Williams Center for Real Estate, Real Gross Domestic Product (RGDP) within the MSA grew about 4.8% annually from 2002 to 2005 and then fell about 0.12% from 2005 to 2016 (vs. growth of 1.56% annually in the U.S.). In addition to the Great Recession, RGDP in the MSA performed poorly due to the deceleration and then stagnant Department of Defense (DoD) spending and lack of job growth in the private sector. This trend improved starting in 2017.

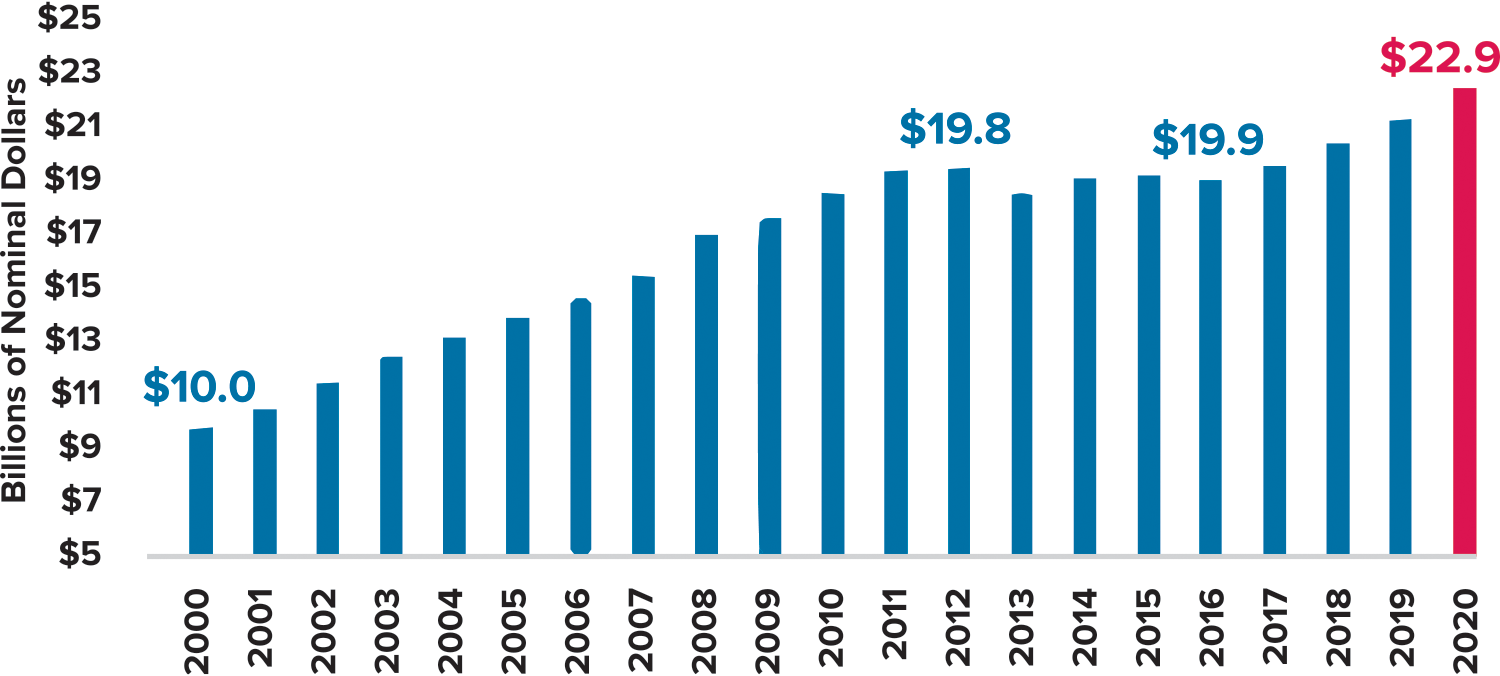

The Hampton Roads MSA continues to be dependent on DoD spending. The Bipartisan Budget Agreement of 2019 increased military spending for FY2020 and 2021, with the E.V. Williams Center for Real Estate estimating that the 2020 direct DoD spending in Hampton Roads will be 15% higher than 2017.

Figure 4: Growth in Real Gross Domestic Product Hampton Roads, 2002-2019*

Source: Bureau of Economic Analysis and Dragas Center for Economic Analysis and Policy. Data on GDP Incorporates latest BEA revisions in December 2019. *Data for 2018 are the advance estimates and for 2019 data represent an estimate. CAGR GDP growth in horizontal bars.

Figure 5: Estimated Direct Department of Defense Spending Hampton Roads, 2000-2020*

Source: U.S. Department of Defense and Dragas Center for Economic Analysis and Policy. Includes Federal Civilian and Military Personnel and Procurement. *Data for 2019 are estimates while 2020 is a forecast. Last updated on January 2, 2020.

Office Real Estate Market

The Hampton Roads office market includes a total of approximately 53M square feet and had a 2019 year-end vacancy rate of 7.8%. Vacancy has trended downward from a high of over 13% in 2011, indicating a strengthening market pre-COVID-19. Due to limited private sector job growth, development has been limited and therefore new development has also been limited but included new space for Ferguson Enterprises and space in mixed-use developments. Pre-COVID-19 speculative development typically required about 25% pre-leasing, but now would likely require a substantially or fully leased building or build-to-suit until the pandemic has ended and the market re-stabilizes. Office development on Oceana would likely be a build-to-suit or full pre-leasing to a larger defense contractor with a use or need that outweighed noise and Air Installations Compatible Use Zones (AICUZ) concerns.

Retail Real Estate Market

The national retail market saw significant store closings in 2019, and successful retailers were changing their formats and marketing with links to entertainment, celebrities, the environment/ sustainability and experiential shopping. With the growth of e-commerce, which has accelerated due to the pandemic, retail has focused on providing entertainment and an experience for consumers. The largest retail leases in 2019 in Hampton Roads reflected this trend, with the top three leases to Apex Entertainment, Surge Adventure Park and Rosie’s Gaming Emporium. New development in the Oceana area would likely reflect that specialty /entertainment trend or be related to the Navy. Considering overall changes occurring with retail, opportunities on Oceana are expected to be limited and therefore would not likely be a focus. It was, however, noticed that there are limited options for lunch dining around Oceana and a restaurant or two near the entrances to Oceana might be successful.

Multi-family Housing Real Estate Market

The Hampton Roads multi-family (apartment) market included over 122,000 units at the end of 2019 with just over 5% vacancy rate indicating a relatively strong market with demand for more apartments outpacing the new supply of 199 units added in the past 12 months. Virginia Beach is the largest submarket within Hampton Roads with over 31,000 units and a similar (5.2%) vacancy rate. With limited new supply being added within the market and a healthy market vacancy rate, new multi-family housing near or on Oceana catering to those employed at Oceana could be successful if noise and AICUZ issues can be addressed.

Industrial Real Estate Market

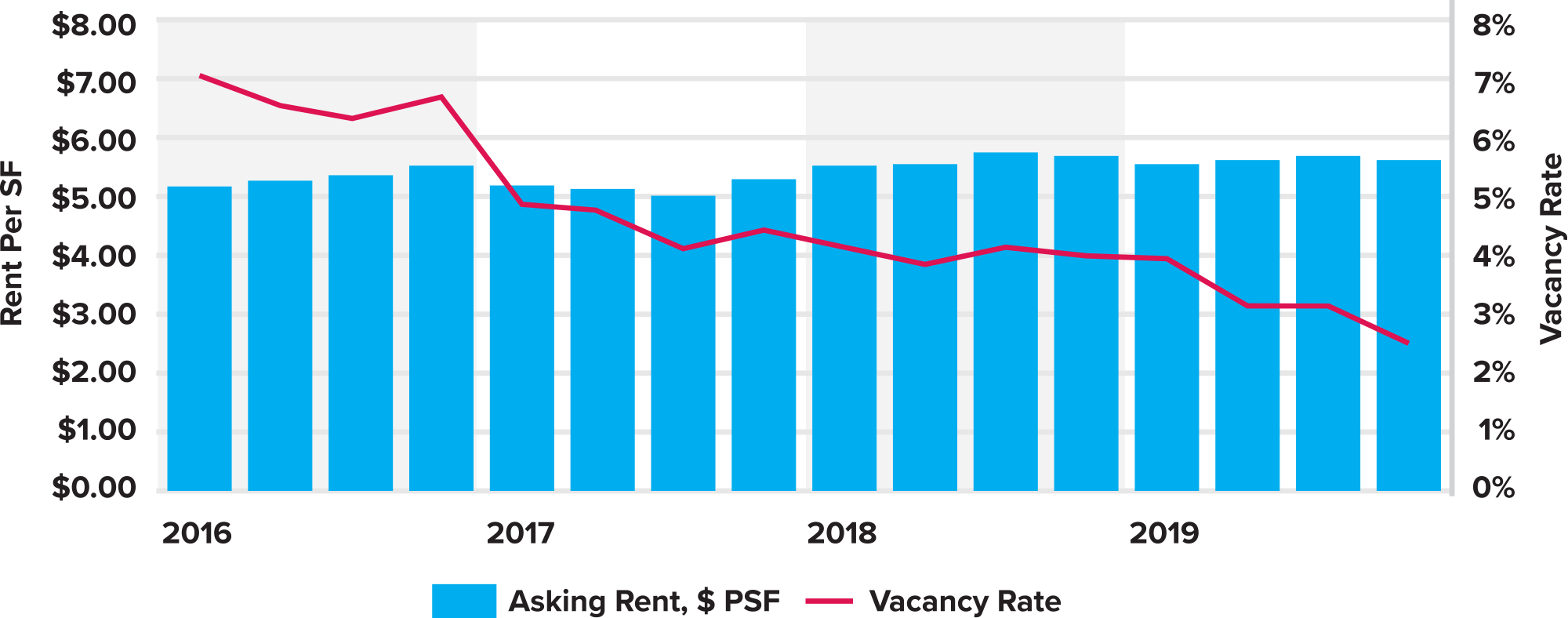

The Hampton Roads industrial market includes over 100M square feet of distribution and warehouse space indicating it is a smaller-sized industrial market and generally has less activity and large investor interest than a large market like Dallas/Ft. Worth or Chicago. This size market is also typically characterized by having primarily smaller warehouse buildings ranging in size from 25,000 square feet to 75,000 square feet. Hampton Roads had a 2019 year-end vacancy rate of just 2.5%. Generally, 2% – 3% of any market is functionally obsolete meaning there is limited interest from companies in leasing obsolete structures. When the market vacancy is this low, it usually indicates there is not enough supply of vacant space to meet the demand in the market, resulting in an opportunity to develop new buildings. Currently, the average market rent rates are not at a level that justifies new development, but new development would be leased at levels significantly above the averages. The chart in Figure 6 illustrates the historical vacancy and average lease rates over the past several years.

The Lynwood submarket (which includes the area surrounding Oceana) includes 8.3M SF and a vacancy rate of 3.2%. Companies that lease larger industrial buildings that distribute their products to retailers or other companies often import their products from other countries reaching the U.S. through shipping ports like the Port of Virginia/Hampton Roads, which is the fifth largest port in the country. Locations for these distribution facilities are preferred to be on an interstate highway near the port connecting to other cities in the region or country. Sites on Oceana would not likely be considered for regional or national distribution facilities, but local distributors would likely be interested in locating on the northern portion of Oceana due to the relatively convenient access to Interstate 264. This is illustrated by the location of the industrial/business park located across London Bridge Road from Oceana. New industrial development on Oceana could be viewed as an expansion to that existing park which has already been established and recognized by the local business community.

Figure 6: Hampton Roads Market Asking Rents Per SF and Vacancy Rate

Conclusions

Spanning the market spectrum (all property types), the available land in the northern portions of Oceana are perceived to have the greatest potential for industrial development considering its locational attributes and AICUZ and noise constraints, provided wetlands limitations can be addressed.

Subject to the number of employees needed, there may also be opportunities for data center development on Oceana to support the two new undersea fiberoptics cables, MAREA and BRUSA. Office development may be permitted within the Central Campus outside the APZ but would likely be generated internally by the Navy with defense contractors. Opportunities for new retail structures are limited primarily due to overall economic uncertainty due to increasing internet shopping trends. Oceana is a significant employer in the region, suggesting new housing would be well received by Oceana employees if AICUZ and noise constraints can be addressed. Furthermore, currently only about half of the housing for sailors (barracks) can be supported by the existing facilities on Oceana outside the APZ. There is an opportunity to provide barracks though the private sector at a lower cost to the Navy via an EUL or City-Base. While not specifically addressed in the data presented, a hotel on Oceana would be well received to accommodate visitors or barracks overflow.

The CRE® Consulting Corps team believes market demand for a variety of property types would support the Navy’s objectives for Future Base Design. The land use offering the least conflict with AICUZ restrictions appears to be warehouse and distribution. However, other land uses within the Central Campus and outside the APZ present unique opportunities for NAS Oceana. We recommend the Navy use the master planning process to explore all options that the market and Future Base Design present. •

The Consulting Corps is The Counselors’ public service initiative. Members of The Counselors volunteer their time and expertise to help nonprofit and government entities by providing objective analysis, adaptive reuse strategies, and realistic action plans to leverage and maximize performance of real estate assets. For more information or to suggest a project that could benefit from Consulting Corps assistance, contact Samantha DeKoven. To learn more, visit cre.org/initiatives/consulting-corps.

Endnotes

1. Dillon’s Rule refers to the 1868 Court case establishing that municipalities are limited to the powers expressly granted to them by the state. “Municipal corporations owe their origin to, and derive their powers and rights wholly from, the legislature. It breathes into them the breath of life, without which they cannot exist. As it creates, so may it destroy. If it may destroy, it may abridge and control.” Clinton v Cedar Rapids and the Missouri River Railroad, (24 Iowa 455; 1868). ↩

Members of the CRE® Consulting Corps team onsite at NAS Oceana in August, 2020.

Members of the CRE® Consulting Corps team onsite at NAS Oceana in August, 2020.